Stock market analysts and investors are currently focused on the rising MRC share price. The factors driving MRC share price increases provide essential knowledge to investment specialists who aim to benefit from market fluctuations. In this article, we will examine expert assessments, historical price changes, and the projected market performance of MRC stock. Investors, together with analysts, have taken notice of the MRC share price’s exceptional rise in value.

Why Is MRC Share Price Rising?

Positive factors connected to MRC stock appreciation are pushing its value higher. Knowing these drivers allows investors to estimate whether this current rally will continue.

1. Strong Financial Performance

The recently released MRC earnings results exceeded all previous outlooks through these figures:

Revenue growth of 15% YoY

Improved profit margins due to cost-cutting measures

Income investors are drawn to the company because of its increased dividend payments.

MRC’s excellent performance causes investors to become interested and results in positive stock price developments.

2. Positive Industry Trends

MRC functions in the [industry sector], where revenue statistics and profit margins demonstrate positive progress, as do sector-specific economic indicators.

Market demands continue to expand at a steady rate due to economic factors.

Favorable regulatory changes

The company achieves better operational performance through supply chain enhancements, which cut expenses.

Various industry-wide trends generate favorable conditions that support MRC stock prices.

3. Institutional Investor Confidence

Hedge funds and mutual funds are showing increasing interest in MRC stock because they believe in the company’s extended growth potential.

Understanding MRC Share Price Rally

Share prices rise in value for a continuous period during stock price rallies. These rallies stem from different drivers, such as solid financial outcomes, favorable market perceptions, and beneficial economic environments. The continuous price increase of MRC stock has caught investors’ attention recently.

Key Drivers Behind MRC Share Price Surge

Multiple factors support the MRC stock market value increase:

- Stock prices increase significantly because investors’ confidence levels fluctuate in the market.

- Market parameters, such as interest rates, inflation, and GDP growth rates, determine how stocks will perform.

- Corporate results, business acquisitions, and market growth strategies generate increased investor optimism about a company’s prospects.

MRC Stock Forecast: What’s Next?

- The predictions regarding MRC share price movement stand divergent among different market analysts. The data points to the following market forecast analysis:

Bullish Outlook

- Price Target: $XX (XX% upside)

- These predictions emerged from rising profits regardless of the company’s progress in market penetration.

- Regional domestic and international analyst firm A, alongside analyst firm B, provide positive statements about MRC share price performance.

Neutral Outlook

- Price Target: $XX (Fair value)

- A slowdown factor exists that might prevent the MRC stock price from reaching its full potential during the rally stage.

- Key Supporters: [Analyst Firm C]

Bearish Concerns

- Risks: Rising competition, economic slowdown

- MRC allows its share price to fall to $XX under certain circumstances when a negative event occurs.

MRC Stock Analysis: Technical & Fundamental Breakdown

To make informed decisions, investors need both technical and fundamental analysis.

Technical Analysis: Key Chart Patterns

- The financial markets have demonstrated a consistent upswing starting from [date]

- Resistance Levels: $XX (Next hurdle)

- A potential buying area is $XX if the price returns to this level.

- The Relative Strength Index holds a reading of [Value], which shows whether MetaCom Indicator Resource Capital’s price is beyond its buying point or has further ceiling potential.

Fundamental Analysis: Valuation Metrics

| Metric | MRC | Industry Avg | Verdict |

| P/E Ratio | XX | XX | Undervalued/Overvalued |

| Debt-to-Equity | XX | XX | Strong balance sheet? |

| Dividend Yield | X% | X% | Attractive for income? |

How Does MRC Compare to Competitors?

MRC isn’t the only player in this space. Let’s see how it stacks up against rivals like [Competitor A] and [Competitor B].

| Stock | YTD Performance | P/E Ratio | Dividend Yield |

| MRC | +XX% | XX | X% |

| [Competitor A] | +XX% | XX | X% |

| [Competitor B] | +XX% | XX | X% |

Key Takeaway: MRC is outperforming/underperforming

Should You Buy MRC Stock Now?

- Before jumping in, consider:

- Pros: Strong earnings, bullish trends, institutional backing

- Cons: Potential overvaluation, macroeconomic risks

- A long-term investor should employ dollar-cost averaging to decrease their investment risk.

Expert Insights on MRC Stock Forecast

Financial analysts have released their predictions about MRC stock through valid assessments.

Technical Analysis: Market activities combined with trading volume analytics indicate a positive market trend will continue.

Fundamental Analysis: The company demonstrates reliable potential based on its revenue expansion, healthy margins, and valuation indicators.

Industry Comparisons: The data about MRC’s market performance helps analysts understand its position among its competitors.

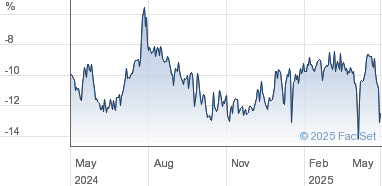

MRC Share Price Trends Over Time

The historical analysis shows several important patterns that affected the MRC share price performance.

Short-Term Trends: Recent fluctuations and market reactions.

Long-Term Growth: The performance of MRC stock during the past years is a key aspect for analysis.

Global Impact: Geopolitical changes, together with economic transitions, impact MRC stock performance.

Risks and Challenges for MRCshare price Stock

The upward trend in MRC stock exists despite several possible risk factors, which include:

Market Volatility: Market downturns at any time will weaken investor commitment to support stock prices.

Regulatory Changes: Business operations will be affected by newly introduced policies.

Competitive Landscape: The market transformation, coupled with advancing competitor presence, generates obstacles for the company.

Investment Strategies for MRC share price Stock

Readers interested in MRC stock investments should follow these approaches.

Diversification: Strategic combinations of MRC stock with alternative investments work to decrease financial risks.

Long-Term Holding: The focus of investment targets continuous development.

Expert Recommendations: Following insights from seasoned investors.

Final Thoughts: Is MRC’s Rally Sustainable?

Investors who purchase MRC share price stock experience multiple beneficial effects during its present price increase. They can make decisions using fundamental industry information and expert recommendations, which also helps them detect existing market risks. Future market movements demand the latest information from MRC stock analysis to make proper decisions.

Market fundamentals currently boost MRC share price increases, although no security experiences perpetual upward movement. Keep an eye on:

- Upcoming earnings reports

- Broader market conditions

- Competitor movements

MRC share price is an advantageous stock investment opportunity, but investors need an independent evaluation before making financial decisions.

FAQs About MRC Share Price

What factor is pushing MRC stock value upward?

A: Strong earnings, sector tailwinds, and institutional buying.

Q: Is MRC a good long-term investment?

MRC shares should be monitored because continued growth could remain positive despite competition risks.

Which platforms is the share price trend for MRC accessible?

A: Use platforms like [Yahoo Finance], [TradingView], or your brokerage app.